Japan’s Fujifilm is buying Xerox in a takeover deal worth more than $6 billion. The companies announced early this morning our time that they will merge Fuji, Xerox and their longstanding Fuji Xerox joint venture into one company. You can see the company’s explanations and a video here.

Japan’s Fujifilm is buying Xerox in a takeover deal worth more than $6 billion. The companies announced early this morning our time that they will merge Fuji, Xerox and their longstanding Fuji Xerox joint venture into one company. You can see the company’s explanations and a video here.

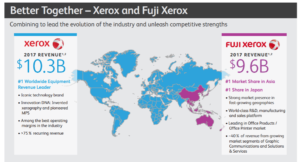

They say the merged companies will be a global leader in print technologies and work solutions with annual revenues of $18 billion. The companies plan to keep the Xerox and Fuji Xerox brand names in their traditional operating regions, and they’ll keep joint headquarters in the U.S. and Japan. Fujifilm will own 50.1 percent of the merged companies.

Xerox CEO Jeff Jacobson will head the U.S. operations and Fujifilm CEO Shigetaka Komori will be chairman.

The merger lets the companies gain market scale and cut costs amid a declining demand for office printing as technology goes paperless. Both companies have been pressured to find new sources of growth and to reinvent their legacy copier and printer businesses for the 21st Century. The two companies say they’ll be able to cut costs by $1.7 billion by consolidating their research, procurement and other operations.

Fujifilm says it’s cutting 10,000 jobs at Fuji Xerox as part of its own restructuring plan. Xerox is being pressured by investors Carl Icahn and Darwin Deason to fire its leadership and explore new strategic options.